Make Smarter Investments.

Own Multifamily Properties.

Grow Your Wealth.

Red Dahlia Holdings LLC strategically acquires rapidly appreciating apartment communities, using a disciplined mix of debt and equity to generate strong returns for our investors.

Our Benefit

Owning real estate is a cornerstone of wealth—providing both financial prosperity and a sense of emotional security.

Consistent Income Stream

Rental income that provides reliable, ongoing returns.

Growth in Property Value

Increase in property value over the long term.

Tax Benefits

Unique Advantages of Real Estate Investing

Protection Against Inflation

Safeguard your investment from inflation.

Professional Management

We manage all aspects for you.

Clear and Transparent Process

Transparent updates and detailed reporting.

Our Process

We source high-potential apartment properties, obtain advantageous financing, and oversee the entire acquisition and management process—offering our investors a hands-off approach to real estate ownership.

Who We Are

Our Goal Is To Deliver Strong Returns

And Give Back to Our Investors

Deerfield Holdings LLC started in the back of a San Diego grad-school in 2006. "During break Chris and I began talking about apartments and how we love rental property because of the safety and security it provides for long term wealth and retirement. The next thing we knew... we bought our first $100,000 condo in 2010 and then bought our first 4 plex and then we had several million in assets. It has grown and grown to where we are. Our next step is to syndicate and develop larger apartment complexes." - Michael Obasuyi

Thorough Due Diligence

Full-Service Support

Clear and Open Communication

Customized Investment Strategies

Optimized Return on Investment

Trusted Industry Expertise

Why Choose Red Dahlia Holdings LLC

📂

Established History of Success

We bring 15 years of experience in real estate investing.

💸

Thorough and Detailed Evaluation Process

We exclusively invest in well-vetted, high-quality opportunities.

💼

Focused on Investor Success

Your success is at the heart of everything we do.

🤝

Dedicated Service

We co-invest alongside you, sharing the same commitment and confidence in every opportunity.

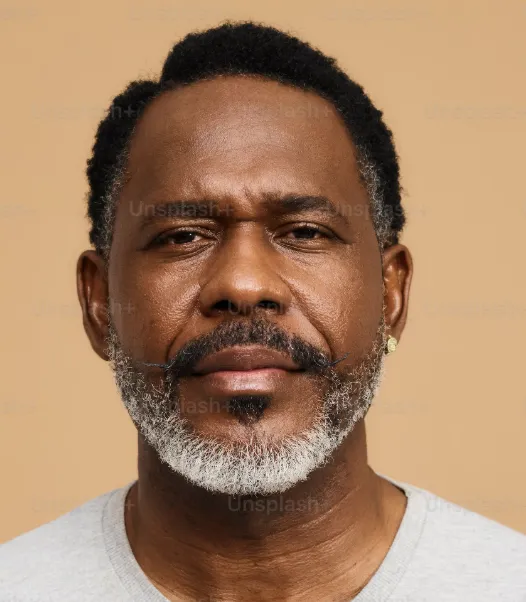

Bryan Hoskins

CEO & Founder, Red Dahlia Holdings

Bryan Hoskins is the Chief Executive Officer and Founder of Red Dahlia Holdings, a privately held real estate investment company with nearly two decades of experience in the California property market. Over his career, Bryan has developed a deep expertise in single-family residential investing, having acquired, managed, and optimized dozens of properties throughout California’s diverse regions.

Under his leadership, Red Dahlia Holdings has established a reputation for disciplined investment strategy, strong local market insight, and a hands-on approach to asset management. Bryan’s extensive experience navigating complex regulatory environments, market cycles, and financing landscapes has enabled the company to deliver consistent performance and build long-term equity in residential real estate.

As part of his vision for strategic growth, Bryan is leading Red Dahlia Holdings’ expansion into the multifamily real estate sector, with an emphasis on emerging and high-growth regions across the Sunbelt, Midwest, and Southern United States. This expansion reflects his belief in the resilience of multifamily housing as an asset class and its potential to create community impact and investor value.

Bryan is known for his entrepreneurial mindset, commitment to operational excellence, and ability to cultivate strong relationships with capital partners, brokers, and local stakeholders. He continues to position Red Dahlia Holdings for scalable growth while maintaining the company’s core values of integrity, diligence, and long-term stewardship of real estate assets.

Advisory Board

Khalsa McBrearty Accountancy, LLP

CPA

Jodha has over 35 years of professional services experience with specific expertise in tax preparation, tax reviews and financial audits. As a graduate from Harvard University, a Certified Public Accountant since 1984 and after obtaining a PhD in Accountancy from the Arizona State University, Jodha is a highly sought out subject matter expert in complex financial modeling and business valuations.

Eric Weingold

Securities Attorney

Erik P. Weingold is an entrepreneur and corporate securities lawyer with over 20 years experience under his belt. He has been practicing law since 1995, and since 1998 has been drafting PPMs that have been used to raise millions upon millions of dollars for startup companies and small businesses throughout the U.S. [Whiteplains NY.]

Clint Coons

Business Attorney

As one of the founding partners of Anderson Law Group, Clint has grown his legal and tax firm to over 200 employees by assisting real estate investors with creating and implementing solid entity structuring plans. His success in these regards is in large part due to his personal investing experience.

Syndication Pro

Investor Relations

Syndication Pro is Brennan Pohle Groups all-in-one investor relations portal. It is important that investors have 24/7 access to their investments, tax documents, updates, videos, investment documents and more. This is a great tool to provide our investors with a transparent investment experience and peace of mind.

Strategic Partner

Justin Brennan

Principle

Founder of The Brennan Pohle Group. Justin focuses on property acquisition, underwriting, construction and development. Justin grew up learning from his father, Jim Brennan, who developed over 8,000 multi- family and single family subdivisions throughout CA,NV,AZ,ID.

What Clients Say

Here’s what our investors are saying about their

experience with us:

Christopher Taylor

The tailored guidance and professional insight I received led to financial growth beyond my expectations.

David Miller

Their strategic investment management has provided me with peace of mind and steady, reliable returns.

Emily Anderson

Partnering with their team has completely reshaped my financial perspective—they genuinely understand my goals and priorities.

Frequently Asked Questions

What are the most frequent questions asked about investing in

apartment buildings by accredited investors.

What types of services do you offer?

We offer three primary services: sourcing properties for direct purchase, providing opportunities to passively invest as a limited partner, or collaborating as a general partner for those seeking a more active leadership role.

How do you determine the best investment?

We analyze numerous properties using advanced AI tools and select those offering the strongest combination of location, cap rate, cash-on-cash return, and overall return on investment.

What is the minimum amount required to start investing with your firm?

Minimum investment requirements differ based on the particular asset in which you are investing.

What Types of Financing Are Available for Investing in Apartment Buildings??

Investors can finance apartment purchases through conventional bank loans, government-sponsored programs, private lending sources, or by participating in syndication deals.

What Potential Risks Should Investors Be Aware of When Investing in Apartment Buildings?

Risks may include shifts in the market, tenant turnover, management difficulties, and unforeseen repair expenses. However, thorough due diligence and effective oversight can help reduce these risks.

What Factors Contribute to the Increase in Value of Apartment Buildings?

An apartment building’s value is closely linked to its rental income. Investors can boost its worth by enhancing amenities, increasing rent levels, and keeping occupancy rates high.

What Tax Advantages Do Apartment Building Investments Offer?

Investors can take advantage of tax benefits such as depreciation write-offs, deductions on mortgage interest, and the ability to defer capital gains taxes through 1031 exchanges.

Your Reliable Partner in Building Wealth and Achieving Investment Success — Dedicated to Securing Your Financial Future.

Quick Links

Company Info

(727) 900-8178

1910 Thomes Ave, Cheyenne WY 82001

Copyright © 2026 Red Dahlia Holdings LLC

All Rights Reserved